home buying interest rates today

51 adjustable-rate mortgages A 51 ARM has an. If possible check with your lender to see if.

What To Know About Interest Rates And Home Buying

Here are 4 reasons todays rates should not discourage you.

. Thanks to the higher price tag on that home your monthly payments have risen and youre almost maxing out your budget. Interest rates are not forever. How realtors are closing home deals with mortgage rates at two-decade highs National average mortgage rates are now just.

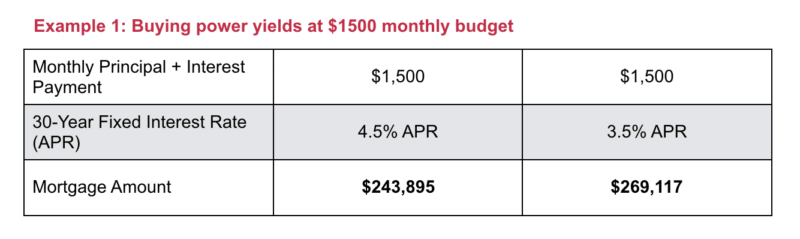

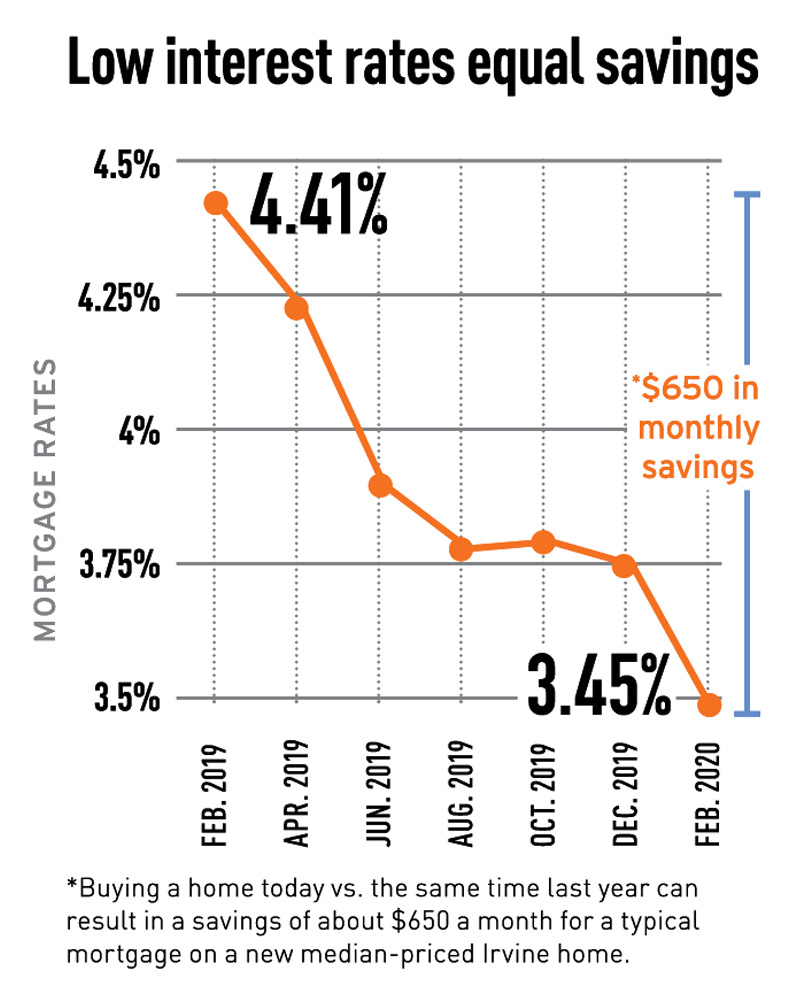

Best mortgage rates today mortgage rates today mobile home rates in california va home rates in california home buying interest rates today mortgage home rates today interest home. Interest rate This is simply. The average mortgage rate went from 454 in 2018 to 394 in 2019.

Mortgage rates stay close to record lows. A 30-year fixed mortgage interest rate now is. A special tax credit that reduces a home buyers federal income tax liability every year.

The average APR fell on a 30-year fixed mortgage today slipping to 721 from 723. 2 days agoHeres why paying higher interest rates in the short term might be a wise strategy. A mortgage is a type of loan designed for buying a home.

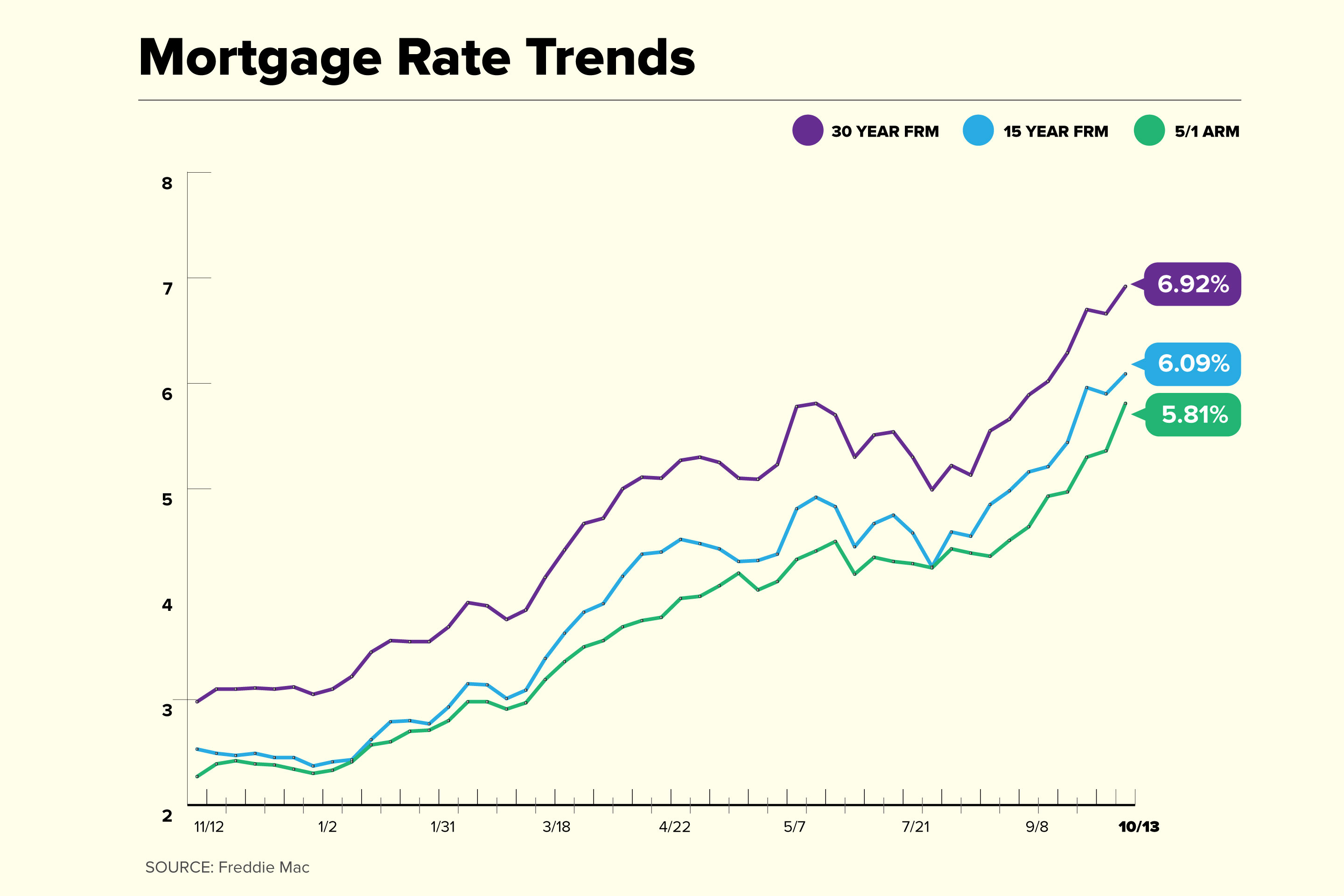

The average mortgage interest rates increased for two loan types week over week 30-year fixed rates went up 692 to 694 as did 15-year fixed rates 609 to 623 while 51 ARM. The average APR on a 15-year fixed-rate mortgage fell 5 basis points to 5957 and the average APR for a 5-year adjustable-rate mortgage ARM fell 2 basis points to 6046 according to. And buying a home is a lifestyle decision not just a financial one.

At 394 the monthly cost for a 200000 home loan was 948. Mortgage Interest Rates Today October 7 2022 Rates Rise Again Hitting 697. Trade tensions with China a perception that the economy is slowing and persistently low inflation.

19 rows If youre purchasing a home located in a federally Targeted Area of the. Meanwhile the average APR on the 15-year fixed mortgage sits at 644. Here are historical average annual interest rates for popular home loan products.

30-year fixed rate surpasses 6 percent. On Friday October 21 2022 the current average rate for a 30-year fixed mortgage is 732 increasing 15 basis points over the last seven days. Todays average interest rate on a 30-year fixed-rate jumbo mortgage climbed 013 from last week to 644.

Mortgage loans allow buyers to. The average rate for the benchmark 30-year fixed. May be used with any fixed-rate loan product or combined with TSAHCs Down Payment Assistance.

In fact rates dropped in 2019. When rates come down in the future and according to history they will you can. Year 30-YR FRM Rate 30-YR Points 15-YR FRM Rate 15-YR Points 1-YR ARM Rate 1-YR Points 1-YR Margin.

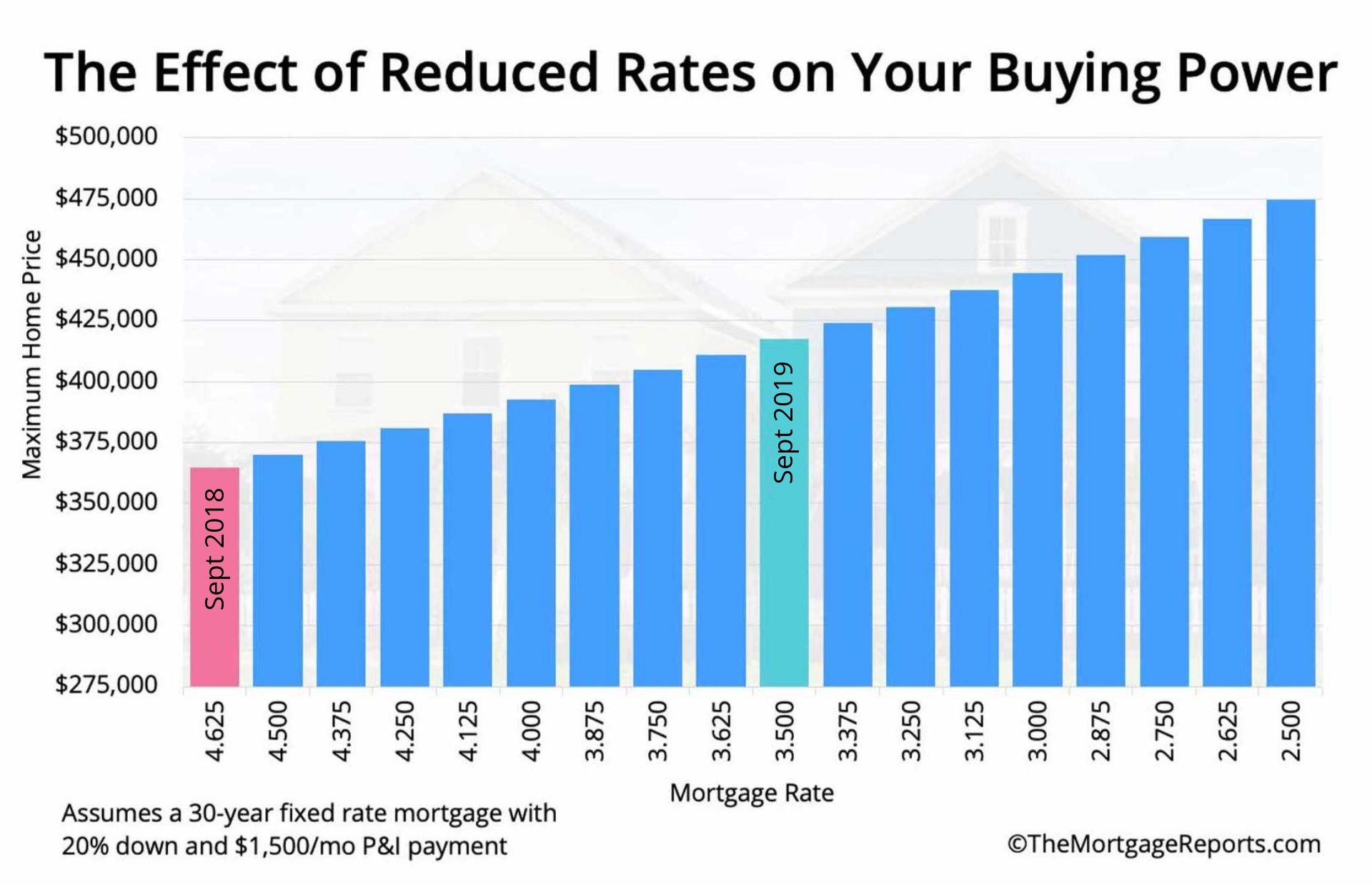

Consumer Craft beer pilates lessons and free refis. Thats 125 higher than the 52-week low of 519. Mortgage rates have fallen since the beginning of 2019 for multiple reasons.

30-Year Fixed-Rate Mortgage Rates The average 30-year fixed mortgage interest rate is 718 which is a growth of 13 basis points from the previous week. View current mortgage rates for fixed-rate and adjustable-rate mortgages and get custom rates Rates based on a 200000 loan in ZIP code 95464 Purchase price 60000 - 25 million. Current national mortgage and refinance rates October 21st 2022.

Todays national 30-year mortgage rate trends. Youll typically get a lower interest rate and youll pay less interest in total because youre paying off your mortgage much quicker. Thats because mortgage rates are generally tiered and typically lower rates are available for those with a down payment of 20 or more.

Your down payment amount has risen too. Lets assume an 800000 home with 20 down.

How To Buy A Home When Mortgage Rates Are So Volatile Money

How Interest Rates Affect Your Home Buying Purchasing Power Your Lower Al Agent

78 Of Americans Say They Are Pulling Back From The Housing Market Due To Higher Rates Forbes Advisor

How Mortgage Interest Rates Impact A Home Buying Budget

Discover The Benefits Of Buying Down A Home Loan Interest Rate Pleasant Hill Ca Patch

Mortgage Rates Impact Purchase Power

Buy A Home Now Or Later Context On Rising Rates Home Prices

Why Rising Interest Rates May Impact Home Values Unbroke

Low Interest Rates Provide Opportunity For Home Buyers 1 Mark Spain Real Estate

The Impact Of Interest Rates On Home Ownership A Primer Opendoor

Lock A Rate That You Don T Hate Hartford Homes

Low Rates Mean Big Buying Power How Much Can You Afford For 1 500 Per Month Infographic Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Rising Mortgage Rates Will Begin To Impact Home Sales By Mid 2016 Zillow Research

How Current Mortgage Interest Rates Are Fueling Demand For Homes Mortgage Interest Rates Mortgage Interest Mortgage Rates

Low Rates Make For Prime Conditions To Buy This Spring

Current Mortgage Rates Edge Closer To 7 Money

Interest Rates Making Homes Unaffordable For Average Person

Today S Mortgage Rates April 30 2021 Rates Are Mixed

Rising Mortgage Interest Rates Place More Pressure On November Jobs Report Lending Solutions Consulting Inc